The U.S.-based financial advisory firm, Bloomberg, has recently reported a concerning situation involving American Transit Insurance Company (ATIC), the largest insurer for commercial taxis, black cars, and for-hire services like Uber and Lyft in New York. According to Bloomberg, ATIC is facing net losses exceeding $700 million, primarily due to fraudulent claims, putting the company on the brink of collapse.

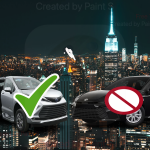

This potential failure would severely impact New York City’s transportation sector. It’s estimated that around 60% of the 117,000 commercial vehicles — including yellow taxis, livery cabs, and ride-sharing services like Uber and Lyft — would lose their insurance coverage, making them illegal to operate unless new insurance is secured. This would pose significant challenges for drivers, as finding new policies could be both costly and complex.

In areas of the city where public transportation is limited, the situation could lead to a mobility crisis. Bloomberg also points out that one of the major issues facing the insurer is the rising size of claims, driven by larger settlements and jury awards, which has substantially increased costs for insurance companies.

In recent years, insurers have seen a notable rise in fraudulent claims affecting everything from ride-share vehicles to delivery trucks. One key reason is that New York has the highest commercial vehicle coverage requirements in the country, making these policies an attractive target for litigators and fraudulent networks.

These fraud networks often involve unethical lawyers, doctors, and shady lenders, who exploit the high insurance premiums to enrich themselves at the expense of insurers and small businesses. Criminal groups, including gangs like MS-13 and Russian mafias, recruit vulnerable individuals to stage accidents in which participants fake severe injuries, sometimes even undergoing unnecessary surgeries to inflate insurance payouts.

A prominent example of this type of fraud is Rex Heuermann, the suspect in the Gilgo Beach murders, who apparently tried to exploit this system. According to reports from the New York Post, in 2014, Heuermann filed a $5 million lawsuit after claiming a taxi driver had run over his foot in Midtown. While the case was settled under undisclosed terms, Heuermann also filed multimillion-dollar lawsuits following other accidents in Maryland, Long Island, and Brooklyn.

This situation has prompted experts and analysts to call for urgent reforms to New York’s civil liability laws in order to reduce insurance costs and dismantle these fraud networks, which are having a negative impact on the city’s economy. New York Attorney General Letitia James, along with district and federal prosecutors, has been called upon to take stronger actions against those responsible for these schemes.

Additionally, the state legislature has been urged to pass laws targeting “fraud brokers” — individuals who train and recruit victims to stage accidents, slips, and falls, especially in the construction industry.

Even if insurers don’t go bankrupt or leave the New York market, consumers will still bear the burden of higher costs. Insurance companies typically pass increased costs onto their customers in the form of higher premiums. Meanwhile, some argue that ATIC contributed to its own crisis by accepting business with premiums too low to adequately cover the risks it took on.

In conclusion, no financial bailout is being requested for these insurance companies, but rather, there are calls to address the root cause of the problem: widespread fraud that has eroded the stability of the industry. Without action, the cost of using transportation services in New York could become significantly higher, assuming you can even find a ride.